A few weeks ago, gold and

silver bugs were cheering at the silver COT report, which was showing large

specs going net short silver for the first time in over 3 years. The narrative went like this: “Last time this

happened in May 2019 at $15/oz, Silver doubled in 15 months.” There is nothing

false about that statement. The last time this happened was indeed in 2019 at

15/oz, and silver did double from there 15 months later hitting $30/oz in Aug

2020. The question isn’t if the statement is false, its “is this relevant to

where we are today?”

Let me back up, as I am

sure there are some people who either have no idea what COT reports are telling

you or why they’re relevant, or worse, they’ve been sold on the incorrect

narrative gold perma-bulls have been shouting for literally decades, about how “J.P.

Morgan/Deutsche Bank/Bank of America etc, silver shorts about to be squeezed

any minute now” and how that will send silver prices to the moon. (Spoiler, it’s

never happened, and it never will.)

COT reports, or the

Commitments of Traders, is a report that comes out every Fri afternoon that shows

the position sizes of 3 major “groups” of traders: large specs, small specs and

commercials. Large speculators are essentially hedge funds. As a group, they are momentum chasers, meaning

they have a tendency to add to long positions as price is moving strongly

higher until their net longs are at very high levels at the market peak, and

inversely, sell their positions as a market goes down until they, as a group,

have very little longs or are even net short at market bottoms. For this

reason, they are often given the nickname “the dumb money”. Small specs are

retail traders. They are basically you and me (but with deeper pockets). Their

positions in a market are typically not very significant and rarely important

in terms of analyzing the COT report, so for the most part we are going to

ignore them.

That brings us to the

commercials. Commercials are the banks. Their positions have a tendency to be exactly

inverse to the large specs, as well as price. As a market moves higher, they

typically are increasing their short positions and as a market moves lower,

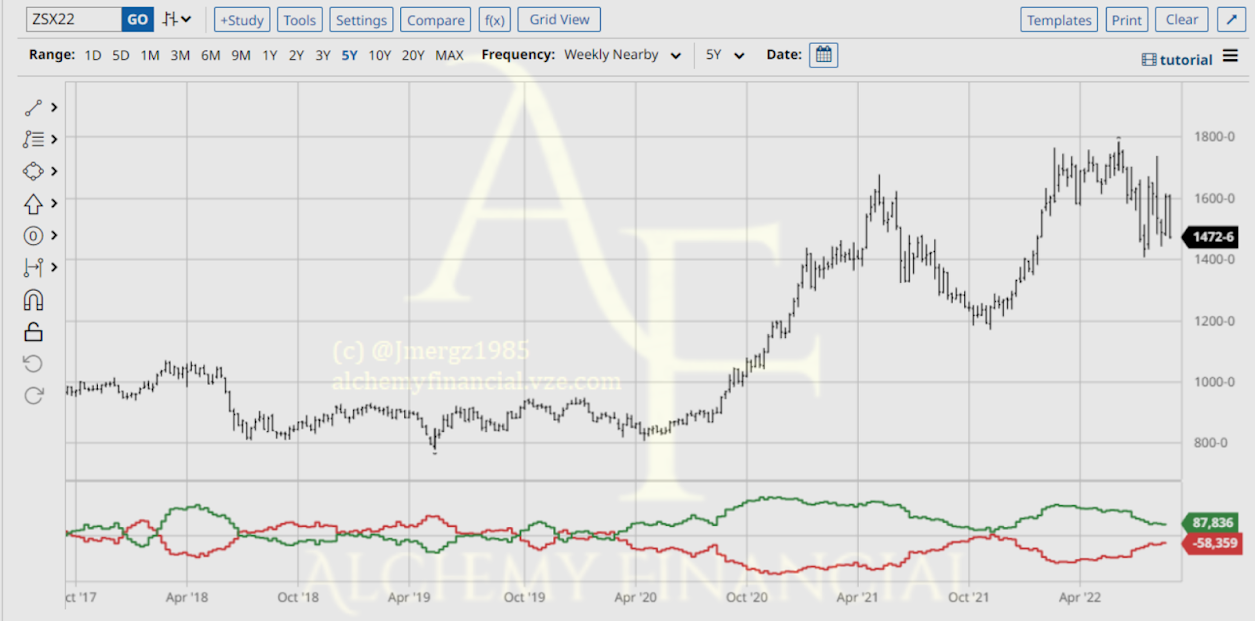

they begin to decrease them or even go net long into major lows. This chart

below of Soybeans over the last 5 yrs is a perfect example of what I mean. The

large specs (green line) were net short soybeans from the end of 2018 until the

end of 2019, when price was ranging between 800-1000, while commercials (red

line) were net long 145k contracts in May 2019 at 800. 1 year later, price had doubled,

and large specs chased it all the way up, going from net short 123k contracts

at 800, to net long 250k contracts at 1600. The commercials on the other hand,

were massively net short at the top.

Now here is where the misinformation

in the gold and silver sector come from. All the talk of commercials (banks) being

massively net short as price is moving higher, and a short squeeze that will

send prices skyrocketing any minute now, is a fundamentally incorrect analysis on

how the market operates. There is a very simple reason why we have never seen this

“J.P. Morgan silver position short squeeze” and why we never will. Because the commercials

are not taking a position in the market betting on price direction either way.

The commercials are

essentially opportunistic merchants. If people want to buy, they want to be

there to sell it to them and vice versa. They are not racking up a massive

short position in silver because they are betting on lower silver prices, they’re

short position is simply the other side of the large specs who are eager to

buy. They profit from the transaction. That

is it. Banks don’t make “bets,” they invest in “sure things.” What you don’t see

regarding their “massive silver short positions,” is derivative holdings that zero

out all exposure to the market in any direction. If prices skyrocket, they

profit and lose nothing. If prices collapse, they profit and lose nothing.

Wall Street is the most

competitive industry in the world. The most intelligent minds on earth don’t

work for NASA, they work for Goldman and Citigroup. These are organizations

that have trillions in assets and the smartest people in the world managing

them, with a goal to take as little risk with them as humanly possible and

still profit. Why on earth would an entity like J.P. Morgan, be stupid enough

to leave themselves open to blowing up their entire firm over a bad directional

bet on silver? Of course those short positions are hedged! Sure, it’s not

impossible that someone could leave themselves open to such a risk (Lehman Brothers),

but it is not very probable and is simply not how they operate in the futures

markets, or how commercial COT positions are supposed to be interpreted.

So, the next time you see

a self-proclaimed “gold and silver expert” and “professional” in the market

talk about commercials or a major bank about to be “squeezed” due to their

silver or gold short positions, promptly disregard EVERYTHING they are saying.

They are either ignorant of how the market works and therefore no expert or

professional in any capacity, (in which case you shouldn’t pay attention to

what they have to say), or they DO know better and are trying to profit in someway

off of the “doom” narrative of a collapse of a major banking firm and a precious

metals “moonshot” (in which case you shouldn’t pay attention to what they have

to say.)

Ok, so where is the

problem here? If large specs, or “dumb money” always chase price higher and

lower and are always heavily on the wrong side at the wrong time, how is this

not spelling out a major low for silver and possibly gold as well? It’s simple.

Because as a rule of thumb, large specs don’t sell bull markets.

Yes, the last time large

specs went net short silver was the last dip in 2019 down near the lows,

anticipating either a retest of 14, the low from both 2015 and 2018, or a break

below it. They were wrong and were forced to cover and chase price higher as it

doubled over the next 2 years. But is that an accurate comparison to where we

are now?

From 2009 to 2011, silver

went from a low of $8, to a high of $50. 2 years of higher highs and higher

lows, exactly what an uptrend or a bull market is. From 2011 to 2013, silver

corrected from that parabolic high and consolidated between 25 and 35. In 2013,

silver began breaking down, making lower lows and lower highs and this

continued for 2 years until 2015, bottoming at $14/oz. From 2016 to 2018 silver

spent 2 years going sideways, retesting its lows as it consolidated at a major

bottom. Then, from 2018 to 2020, it spent 2 years going higher again, and from

2020 to 2022, another 2 years consolidating.

From 2009-2011 as silver

made higher highs and higher lows, large specs NEVER went net short silver.

From 2011 to 2013 as silver consolidated going sideways from 25-35, large specs

NEVER went net short silver. In fact, for the total of those 4 years, the

position size of the large specs never fell below 6k contracts net long. The first

time large specs positions dropped below that (and were nearly net short) was

in June 2013, as silver began making lower lows. Their position size dropped to

837 contracts, down from 41k contracts 7 months earlier.

Over the next 6 years, as

silver continued lower, their long position sizes decreased significantly

versus the previous years when silver was moving higher and consolidating after

a big rise. In March 2018, they were net short 13k contracts at ~16.50 an oz.

In November 2018 they were net short again by 11k contracts. In May 2019 they

went net short a 3rd and final time at $14.50/oz. That is a total of

3 times they went net short during the consolidation at lows in a bear market,

and one time where they were nearly net short as silver began its decline in

2013, breaking down from its consolidation and beginning a trend of lower lows and

lower highs.

Today, we have a silver

market that was moving higher from the lows in fall 2018 to the highs in Aug 2020.

In one instance in May 2019, they were net short. They quickly flipped that

wrong position and 2 months later, they were net long 64k contracts. From

2020-2022 as silver was consolidating between 20-30/oz, they were NEVER net

short silver. Now, as silver has started to decline, making lower lows and

lower highs, surprise, surprise, large specs have gone net short again.

So, you tell me, does where

we are today sound like the final low after a long, brutal decline in price over

a period of 2 years, and a long basing consolidation at those lows for another 3

years? Or does it sound more like that initial drop in long positions that

large specs had in silver in 2013, that was almost net short as price BEGAN making lower lows and lower highs?

Yes, large specs going

net short a few weeks ago is likely piled too far on the bearish side and A low

is likely to occur, as it has in the past when they’ve gone net short or

reduced their long positions significantly. In fact, that is exactly what

happened, and I pointed out that I expected we were making A low in silver on

July 13th, and that we could rally up to 21, but this low was not a

good idea to go long on and a better opportunity would be shorting the rally

after it occurs. Silver bottomed the next day on July 14th and 1

month later hit $20.85. That was just 2 weeks ago and we are now at 17.40, a

17% loss and a new low.

But much like in 2013, it

was just A low, not THE low. I know many are interpreting this as the end of

this decline being near, but I see it exactly opposite.

This isn’t the bottom or

the end of the decline, it’s confirmation that we are indeed in a bear market,

and likely still the early stages of it.

I know that’s not what

people want to hear, but that is the reality, and I’ve been warning of this

risk for 15 months, since June 2021. I said miner’s underperforming is a big

warning sign, like it was in 2013 and it has been again. GDX has lost 36% and

GDXJ has lost 42% since then. I said miner’s lead the metals and they are

leading them lower today like they were in 2013 and they have continuously made

lower lows, just like they did then. GDX, GDXJ, SIL & SILJ all broke to new

lows long before silver followed. Gold has yet to break 1680, but I think that

time is very near. I said sentiment will get very bearish and stay there for

long periods like it did from 2013-2015 and it has again. I’ve pointed out COT

positions in bear markets can drop much lower like they did from 2013-2015 and

they have again as well. I’ve said price can get very oversold and stay there

for long periods like it did from 2013-2015 and we have also seen that repeat

again. All while perma-bulls accused me of “selling at the low,” shouting the

most dangerous words in investing in response to my analysis: “It’s different

this time.”

Ladies and gentlemen,

there is nothing new under the sun. History doesn’t always repeat verbatim, but

it does rhyme, and this time has rhymed near perfectly with 2013. The macro

doesn’t matter. PE ratios don’t matter. Fundamentals don’t matter. The only

thing that matters, is the human emotions of greed and fear. That is what makes

up day to day price action, and that is why we can see so many similarities in

price action in the gold and silver sector today, with what happened in 2013.

Ironically, many of the

same people shouting “it’s different this time” are the ones who have shared

comparison charts of the S&P-500 today versus in 2008. Was the macro not different

then? Even the S&P components were different then! But human emotion is not,

and we can see that play out in nearly identical price action. The Macro in the

1600s in The Netherlands was very different from the United States in the 1990s.

The fundamentals of tech stocks and tulip bulbs were different as well. Yet,

the chart of price action in both is identical, because price action is not dictated

by fundamentals or macro-economics. It’s greed and fear. That’s it.

Before I wrap this up, I

wanted to mention a few more things regarding the environment in the precious

metals sector versus 2013. It continues

to be remarkable to me how similar the things people are saying and doing today

versus back then. It truly is identical, and people don’t even seem to notice

they are doing it. For those who didn’t live and trade through it, I will give

you some examples of what I saw happening then. You decide how similar it is to

today, and whether that is as worthy of serious concern as I have thought (and

continue to think) it is.

First, everybody was in disbelief

that it was happening. When the Fed hinted at taper in 2013, the gold

perma-bulls crowed that they could never do it, that the entire economy and

financial system would collapse if they even decreased their printing by even

just a little. When they did, they said “they’ll reverse and start increasing

their printing again within a month or 2”.

Then it was that they could never raise rates, for the same reasons, an

immediate collapse. When they did, they said, “one and done” and that they’ll

be cutting again (from 0.25%, lol) in months. They screamed about the national

debt, and how rates at just 2% would increase our interest payments on the debt

by “X” amount, and the Fed would never allow that to happen. (That was 15

trillion dollars ago). Everyone was waiting for the “pivot” that would

certainly send gold much higher when it came. It wouldn’t come for another 4

years, and when it finally did, gold had already rallied 25% from the 2018 low,

so the idea of buying gold when the fed pivots, was a misguided plan of action

to begin with.

People were talking about

poor sentiment that continued to get worse, sharing charts like the Gold miner’s

bullish precent index at levels below 10, which MUST mean we are at a bottom. It

stayed below 10 for 6 months in 2013. (Today, the gold miners bullish precent

index has been below 15 for 2 straight months). Many were talking about how miners

were trading at the same levels that they were when gold was 1300, but yet it

was north of 1550. They thought that in the most competitive industry in the

world, there was a free lunch being left on the table for any idiot who can

look at a chart and see a discrepancy between miners and the metal to gobble

up. Easy money buying miners here, right? Miners didn’t revert back to pricing

gold at north of 1550 and have huge gains, instead gold fell to 1300. I’ve seen

a lot of people saying in the last few days, that GDX and GDXJ are trading like

gold is back at 1400. That does not mean an easy money opportunity, just as it

wasn’t then. It’s a warning that gold is likely going to fall to 1400.

People were already on the edge. By the time gold was ABOUT to break support at 1550, GDX had already lost 50% from its 2011 peak. (Currently, at 23, GDX has lost 50% from it’s 2020 peak of 46, and again, gold has not broken it’s support at 1680, yet.) If history repeats from this point, we have a dark future ahead for us. Many are already on edge again today but are holding on because they know it is foolish to sell when miners are already down 50%. They’re about to witness the worst losses in a single day that their portfolio has ever suffered. When gold broke support at 1550, it was a total of $500 down to get to our final low at 1050 2 years later. Half of that $500 in losses came in just 2 back-to-back days once support broke. Major silver producers were down 20% in 1 day. Major gold producers were down more than 10%. Jr’s got obliterated. Many suffered such extreme losses, (and later forced dilution at extremely low prices) that it rendered it nearly impossible for most investors to get back to even, let alone to ever see a profit on those investments.

We

did see a bottom about 1 month after that and a decent rally following, but

then it was back to making lower lows in what ended up being a market that

started as a bullet to the chest, and ended with “death by 1000 paper cuts” 2

years later, for an ADDITIONAL loss of nearly 50% from those break down lows on

GDX (From 67 in 2011, to 35 in 2013 BEFORE gold broke support, to 22 in 2013 AFTER

gold broke down, then to 12 in 2015 when it finally bottomed).

Being that miners had

already been so weak before the breakdown in gold, everybody thought it must be

a flush out, capitulation bottom. It wasn’t. They’ll say the same again when

gold breaks 1680. It won’t be capitulation this time, same as it wasn’t last

time. It won’t truly be capitulation until most of these talking head,

perma-bulls in gold just disappear entirely. When NOBODY wants to talk about gold at all. (Here’s an example. A PM analyst I

knew in 2015 left his job to go become a dentist, because the sector was that

bad. THAT is what you see at capitulation lows, not moderate depression amongst

an ever-stubborn group of perma-bulls. What we need is epic and total despair,

and we unfortunately are not there yet.)

The break is coming, and

very soon, I fear. Time is up. With a long weekend ahead of us, I wouldn’t be

surprised to see gold open next week down $50-100. And then do it again the following

day. No, I am not kidding or exaggerating. I think we breakdown hard and very

soon. I’ve done all I can to warn as many people as possible for the last 15

months, to try and help people from making the same mistakes I saw so many make

back then that bankrupted them. If you haven’t taken any actions to protect

yourself, you are now at the mercy of the market. The only thing left to say

is, “Good Luck.”

-Jonathan M Mergott